Property Access FAQs

-

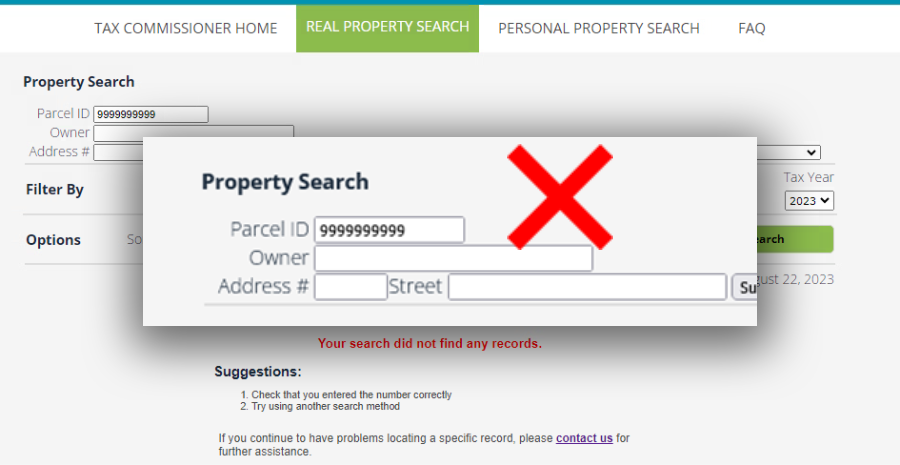

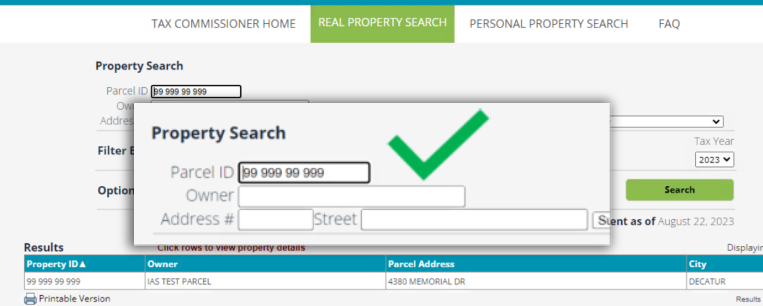

How do I search for my property?

Property information can be searched by parcel ID, LAST and FIRST name of the owner, or street address. Use the following format in the search fields:

• Parcel ID: Enter partial or complete 10-digit number with spaces.

• Owner: Enter the LAST name only, or LAST name with a space and then FIRST name.

• Address: Enter partial or complete address using the street number and/or street name.

-

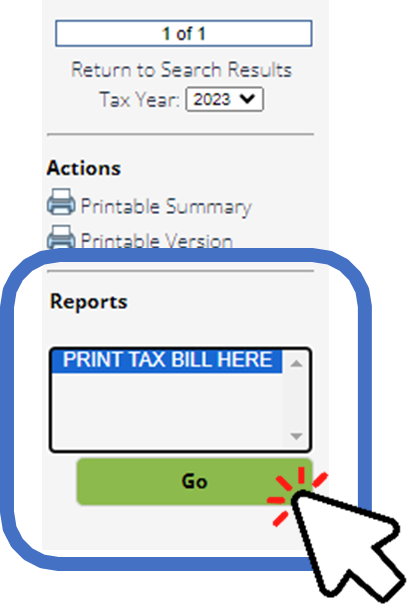

How do I print my tax bill?

Tax bills can be printed from the Property Summary page. On the right side of the page (right column) look under Reports, select PRINT TAX BILL HERE, then click the Go button to generate a tax bill for the tax year selected.

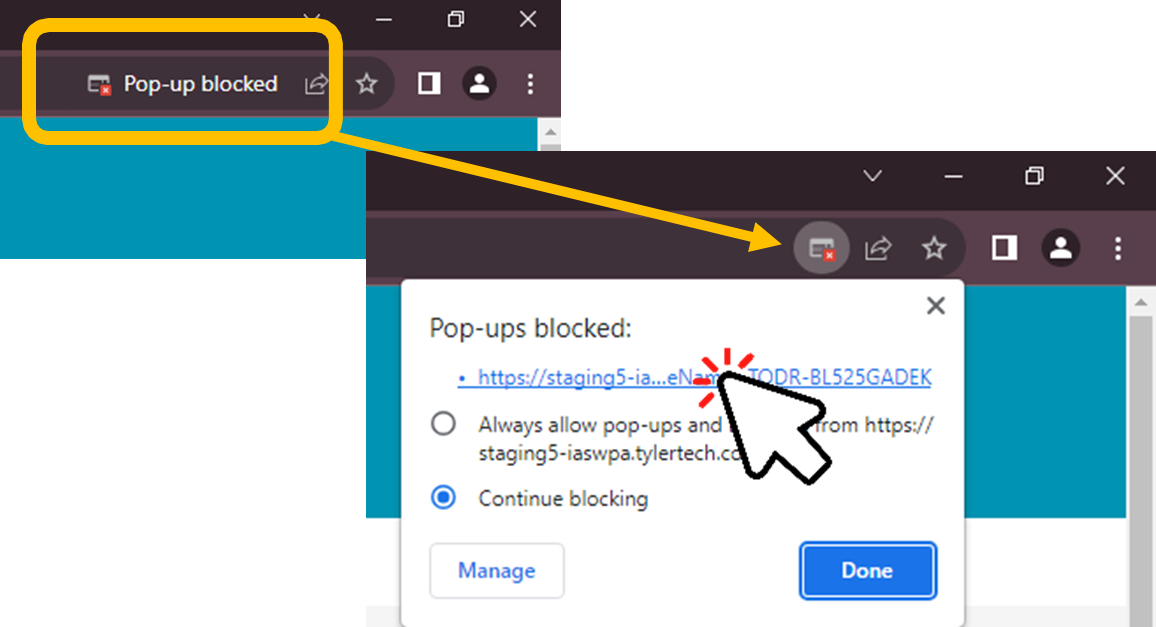

If you are using a browser with a pop-up blocker enabled, you will need to click the pop-up blocked icon then click the hyperlink to view your tax bill.

-

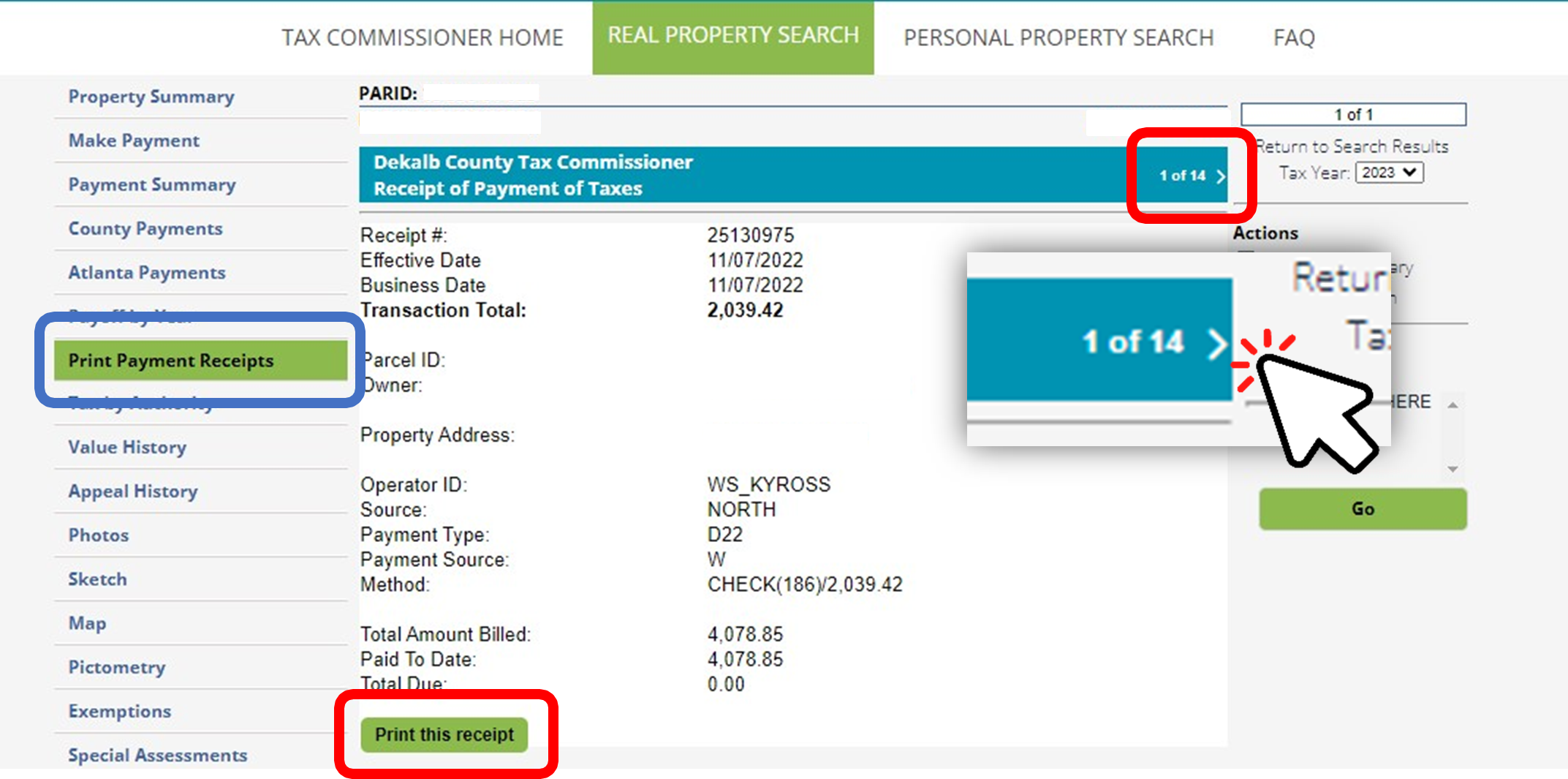

Can I print my payment receipt?

There are multiple ways to print a property tax payment receipt:

• On the left-side of the page, select the tab Print Payment Receipts, then click the Print this receipt button located at the bottom of the receipt. This will print a copy of the most recent receipt.

• To print receipts from previous years, click the arrow on the upper-middle part of the page to cycle through receipts. The page will display each receipt by installment and year.

-

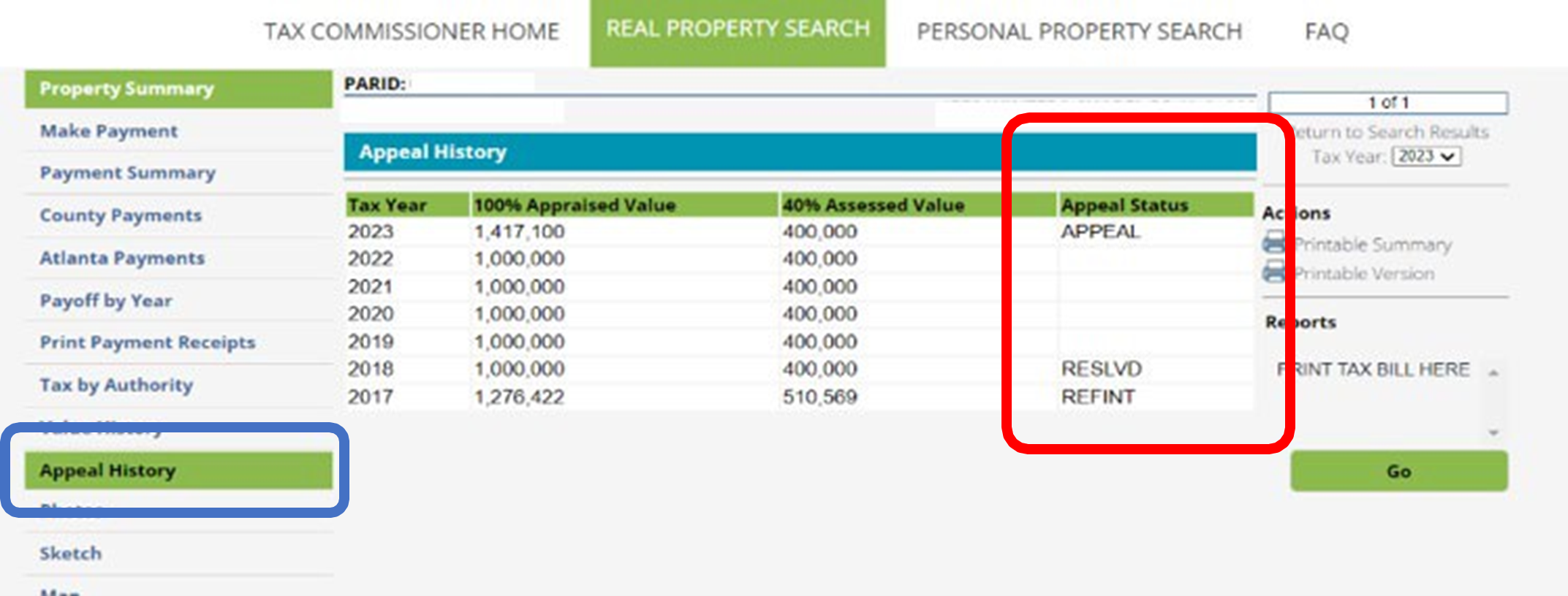

Where can I find my appeal status?

The Property Appraisal office is responsible for appraisals and assessments; however, the appeal status can be viewed by selecting the Appeal History tab on the left-side of the page.

• APPEAL indicates that a property is currently in the appeal process.

• RESLVD indicates that a property has completed the appeal process.

• REFINT indicates that a property has completed the appeal process and received a refund with interest.

For questions about your appeal status or property assessment, contact the Property Appraisal office at 404-371-0841.

-

How do I make a payment?

Online payments can be made by clicking the Make Payment tab. The page will redirect to the payment portal where you have the option to pay the first installment, or the first and second installment at the same time. Acceptable forms of payment are credit/debit cards and eChecks. There is no fee for paying by eCheck.

If you are unable to make a payment online, payments can be made over the phone by calling 770-336-7500. Payment can also be made in person, by drop box or mail.

-

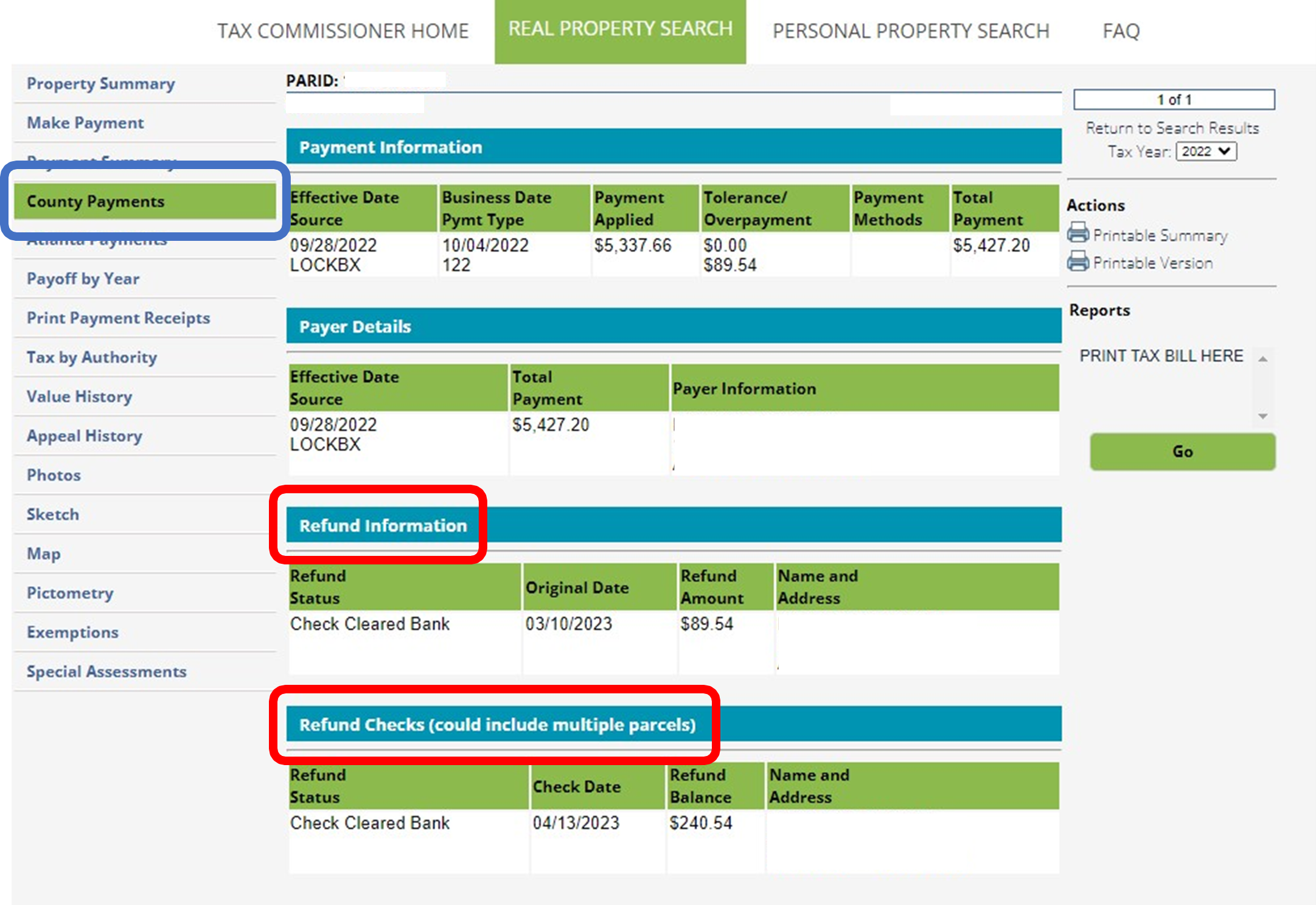

Where can I find my refund status?

If you are due a refund, check the status by selecting the County Payments tab. Look for the Refund Information section; it will include all supplemental information regarding the refund. If a refund is being generated or has been generated, it will be indicated in the Refund Status section.

If your property is in the City of Atlanta portion of DeKalb and you are due a refund, select the Atlanta Payments tab.

-

Additional Information

For more information about property taxes, please visit the Property Tax page at DeKalbTax.org.